How to complete Income Stream Review form for Centrelink Age Pension – Human Services

The age pension is a great benefit that is almost essential to ensuring that many elderly Australians do not live in poverty. The pension in essence allows them to receive a constant income to cover the basic essentials of life throughout retirement.

With the advent of superannuation just over 20 years ago, many retirees now will also have other sources of income streams to supplement the Centrelink age pension. Unfortunately however some of the forms from Human Services / Centrelink can be confusing. So in this article, and through more in the coming months, we will try to demystify some of these forms for you.

The first form we will look at is the Income Stream Review Form.

This form is usually sent in August every year to people who are already receiving a retirement income stream. An income stream can be from an annuity that you have purchased, from an account based pension, from a Self Managed Super Fund (SMSF), or another superannuation account or from another retirement product.

This form is simpler than the other retirement forms that Centrelink has, as most of the complicated details have been completed on the Details of Income Stream Product form (SA330) (http://www.humanservices.gov.au/customer/forms/sa330). Even still, it can be confusing if you haven’t done the form before. So let’s begin….

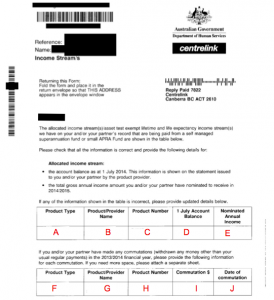

To explain please refer to the picture below along with these instructions. I have labelled the six boxes with the letters A to J. Please note that sections A, B, C, F, G, H will usually be pre filled by Centrelink and you will not need to change the pre-filled information.

Product Type (A): This section describes the broad product type category of your income stream. For most people this will be “Allocated Income Stream”.

Product/Provider Name (B): If you have a personal superannuation account (rather than a SMSF) this will usually have the product name such as “XXX super fund Allocated Pension”. If you have a SMSF it will likely just contain the term “Allocated Pension”.

Product Number (C): If you have a personal superannuation account or annuity this will have the account number to recognise the specific account. This number is mainly used to differentiate this account from any other income streams that you may have now or in the future. If you have a SMSF you won’t have a product number as such, so it may have your name instead.

1 July Account Balance (D): Here you need to look at the end of financial year statements that you have received and put in the asset value of your income stream as at 30 June/1 July. If you have a personal superannuation/pension account with a company such as MLC or Australian Super etc, you just need to look at the account value as at 30 June on the statements they provide you.

If you have a SMSF it is a bit more difficult, as this Centrelink form will likely be due before your SMSF accounts are completed. In this case Centrelink understand that many people won’t have completed their SMSF accounts and you should give your best estimate of your 1 July account balance (your financial adviser may assist you with this). You can then update Centrelink with the correct balance once your SMSF accounts are completed. Please note that if your SMSF has multiple members (a husband and wife for example) you should only put the portion of the SMSF balance that relates to you. For example if you have $200,000 in your SMSF and $150,000 is your portion and $50,000 is your partner’s portion, you should only write in this area just $150,000

Nominated Annual Income (E): Here you write the income that you plan to take in the next financial year. Of course situations change and you may need to take extra income during the year from your superannuation. In such a case, you can later advise Centrelink (within 15 days of the change) that you have drawn additional income above what you had previously written on the form.

For example if you draw an income of $1,000 per month you would write the total year’s expected income drawings of $12,000. If you take $500 per fortnight you would write $13,000 for the full year.

Product Type (F): This will be the same as A.

Product/Provider Name (G): This will be the same as B.

Product Number (H): This will be the same as C.

Commutation $ (I): If you have made any commutations during the year you should write the dollar value here. Most people will not have made any commutations during the year, so this will be $0.

Date of Commutation (J): Again, if you have made any commutations you should write the relevant date. If like most people you haven’t made any commutations you should write “N/A”.

So there you have it, by following these steps you should now successfully be able to completed this Centrelink Income Stream Review form. If you need any further assistance however, please contact your financial advisor or contact AJ Financial Planning for a FREE no obligation consultation.